Posted inFinancial Literacy SEBI

The Hidden Profits of Frontrunning: SEBI’s Failure to Address Grey Market Gains

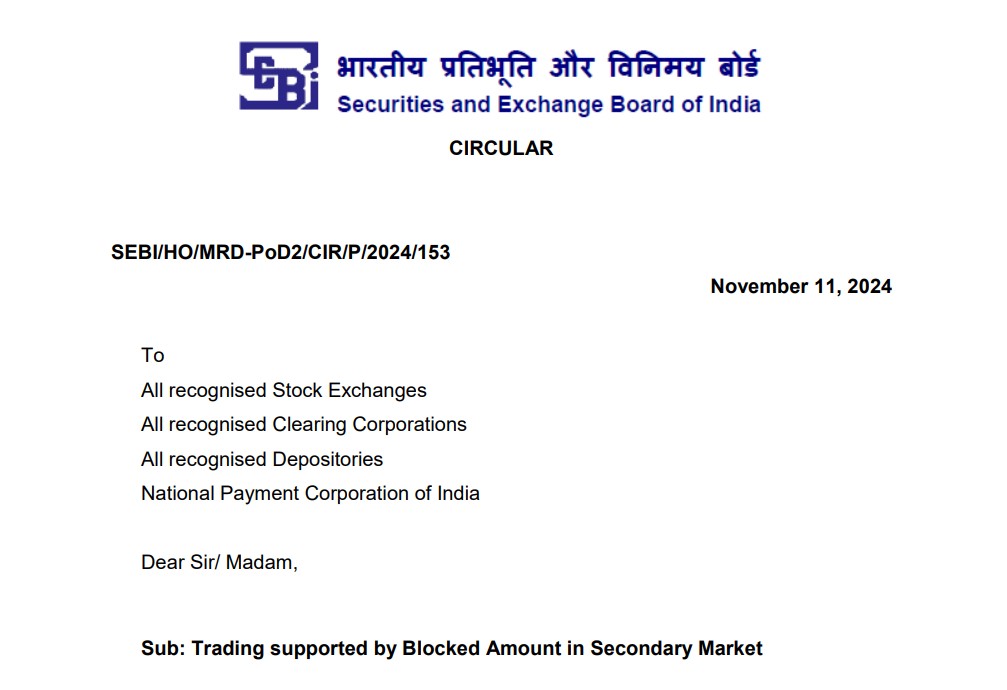

Frontrunning has been a significant issue in the stock market, and SEBI has taken a strong stance against it. The regulator has been imposing…