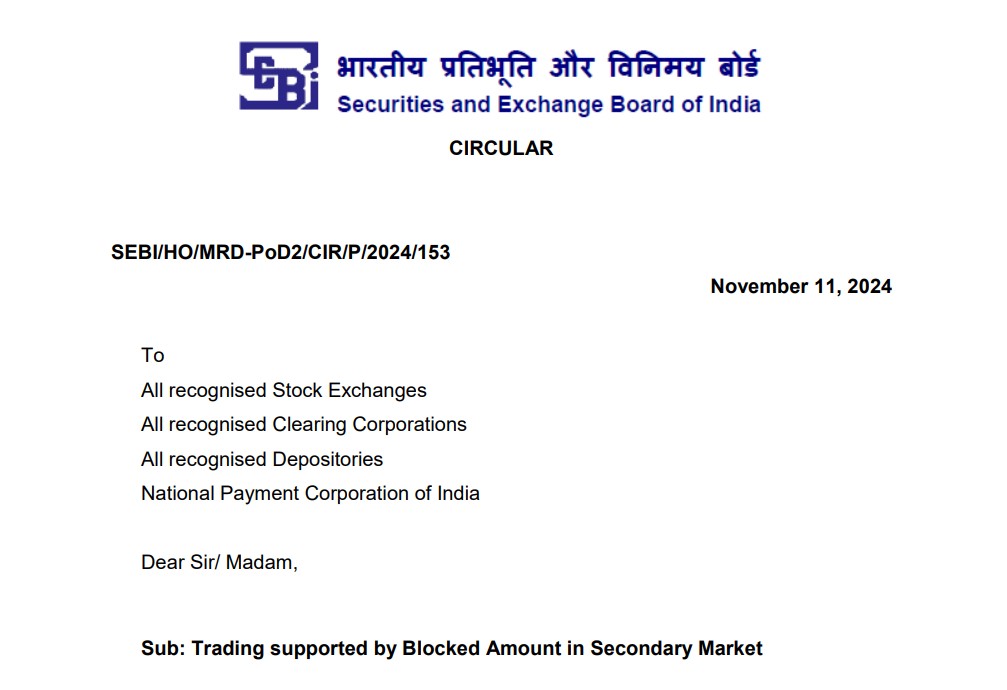

Posted inFinancial Literacy SEBI

Bhasin Ke Haseen Sapne: SEBI Turns Dream into a Nightmare for Sanjiv Bhasin

The vigilant market regulator SEBI has caught yet another heavyweight of Dalal Street in its regulatory net. This time, it’s Sanjiv Bhasin—known for his…